2025 marks a new stage of evolution for the Web3 ecosystem. Beyond blockchain itself, the convergence of AI, high-speed blockchain infrastructure, and decentralized finance (DeFi) is creating an entirely new economic paradigm. Projects like Aethir’s DePIN innovation, Polymarket’s prediction markets, and Upbit’s GIWA blockchain show how Web3 initiatives are moving beyond speculation to solve real-world problems and connect with everyday use cases.

Within this wave, one project stands out: Based, built on the Hyperliquid blockchain. Recently backed by a strategic investment from Ethena Labs, Based is not just another DEX—it’s an attempt to redefine the philosophy and practicality of DeFi itself.

What is Based?

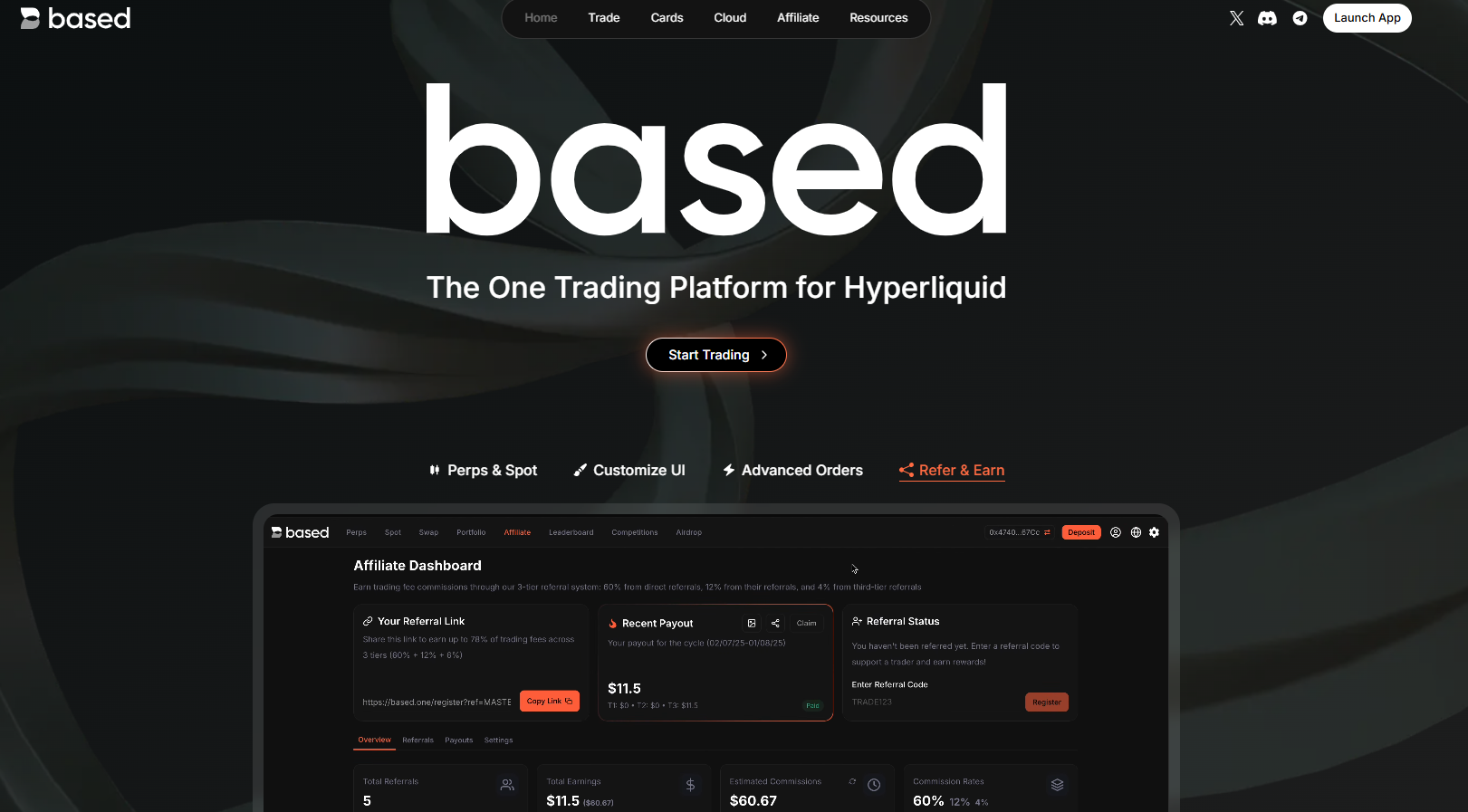

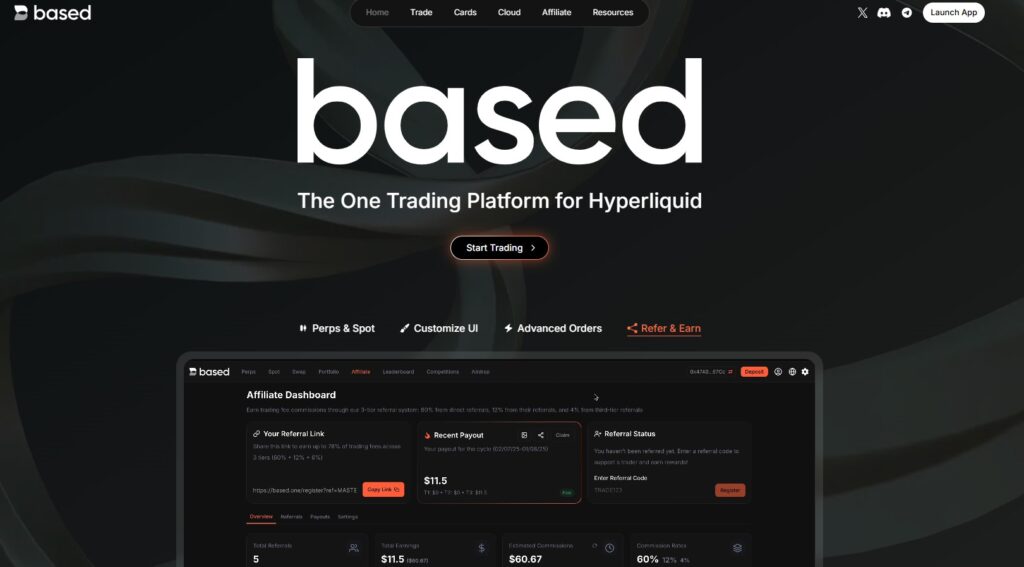

Based is an omni-channel decentralized trading platform built on Hyperliquid. Calling it just a DEX would be an understatement. Based allows users to access trading seamlessly through web, mobile apps, and even Telegram bots, lowering barriers to entry and making trading more accessible than ever.

At its core, Based embodies the ethos of “Stay Based”—practical, transparent, and community-driven. While most DEXs stop at providing a trading interface, Based expands the Web3 experience through three key pillars:

- Trading Platform (Composable Trading Terminal): Provides AI-powered trading bots, automation strategies, liquidation heatmaps, and other mini-apps so traders can make more informed decisions.

- Project Launchpad (Basedpad): A zero-fee, whitelist-driven launchpad for new projects, giving communities a fair chance to participate from the start.

- Real-world Connection (USDe integration): Leverages Ethena’s synthetic stablecoin USDe for liquidity and stability, with debit card features in development to enable real-world crypto spending.

In short, Based is more than just a place to trade—it’s a comprehensive DeFi hub connecting traders, builders, and real-world users. This is why some in the community call it a “DEX beyond DEX.”

Origins and Philosophy of Based

By 2025, Hyperliquid has already emerged as one of the fastest-growing Layer 1 blockchains. Its daily perpetual futures trading volume exceeds $40 billion, putting it in direct competition with Ethereum L2s like Solana and Base. With transaction costs below $0.01 and throughput in the tens of thousands of TPS, Hyperliquid has become known as “CEX-level trading with blockchain transparency.”

Based was launched in late 2024 to take advantage of this infrastructure. Unlike typical apps, it positioned itself as an omni-channel platform spanning multiple user touchpoints. Its guiding principle, “Stay Based,” has since become a cultural marker within Web3, symbolizing utility, transparency, and community focus.

Since launch, Based has captured around 7% of Hyperliquid’s trading volume, reaching a cumulative $8 billion in lifetime trades and attracting over 10,000 users by September 2025. The real turning point came on September 8, 2025, when Ethena Labs announced a strategic investment. Known for its synthetic stablecoin USDe and over $1 billion TVL, Ethena’s involvement signals not just capital but credibility and ecosystem integration. Based is now positioned as the primary conduit for USDe adoption within Hyperliquid.

DeFi’s Old Problems and Based’s Solutions

Despite its innovations, DeFi has long been plagued by structural issues. Based aims to address three of the most critical ones:

1. High fees and poor UX.

On Ethereum mainnet, gas fees often make simple transactions prohibitively expensive. Hyperliquid’s ultra-low fees, combined with Based’s intuitive UI—including one-tap position management, automated take-profit/stop-loss, and trailing stops—dramatically lower the barrier for new traders.

2. Lack of stablecoin liquidity.

High-speed blockchains often struggle with stablecoin integration, limiting use cases. Based solves this by integrating Ethena’s USDe, backed by staked ETH and hedging positions, and extending to USDtb, tokenized through BlackRock’s BUIDL fund.

3. Unfair project launches.

In many Web3 launches, tokens are allocated heavily to insiders and VCs. Based counters this with Basedpad, its zero-fee launchpad that uses community whitelists for fairer early access.

Much like Polymarket reduced information asymmetry in prediction markets, Based is working to make DeFi more accessible and transparent.

Innovation on Hyperliquid

Hyperliquid differentiates itself by using a proprietary validator network rather than optimistic or ZK rollups. While this means it’s not EVM-compatible, the payoff is extreme scalability and speed. With over $1.3 billion in annual revenue already, Hyperliquid is a serious DeFi infrastructure player.

Based leverages this foundation through three primary avenues:

- Composable Trading Terminal: Mini-apps for bots, automation, and analytics.

- Basedpad: A fair launchpad for projects.

- USDe Integration: Stablecoin liquidity and real-world debit card utility.

Together, these form a triangle of trade, launch, and real-world use.

Market Context and Risks

The DeFi landscape in 2025 is highly competitive. Solana, Base, and other high-speed chains are expanding their ecosystems, while incumbents like Uniswap, dYdX, and PancakeSwap remain formidable players. Based differentiates itself through:

- AI integration for smarter trading.

- Fair launches via Basedpad.

- Practical utility with USDe and debit card features.

However, risks remain. Hyperliquid’s validator model has raised concerns about centralization. Regulatory tightening, especially under EU’s MiCA framework, could affect DeFi broadly. Meanwhile, Ethena’s withdrawal of its USDH bid in early September sparked community unease, highlighting policy uncertainty as another potential stumbling block.

Ethena Partnership and Growth Drivers

Ethena’s September 8 investment announcement was a watershed moment, drawing 160,000 views on X and igniting community excitement. Ethena’s incentive program, worth up to $150 million, positions Based as a key channel for USDe liquidity within Hyperliquid.

Based’s current achievements include:

- $8 billion cumulative trading volume

- 10,000+ users

- $500,000 in affiliate payouts

Looking ahead, Q4 2025 promises new catalysts, including the HIP-3 market (a rewards-based collateral model) and LayerZero cross-chain bridge integration.

Conclusion

Based combines Hyperliquid’s speed, Ethena’s stability, and a community-first philosophy. It is not just another DEX—it’s an ambitious attempt to bridge trading, project launches, and real-world spending into one integrated platform.

As 2025 progresses, watching how Based brings its “Stay Based” philosophy to life could offer a glimpse of DeFi’s next wave.

Do you think Based has what it takes to become a next-generation DeFi leader? Share your thoughts in the comments!