🪙 What Is the YZY Token?

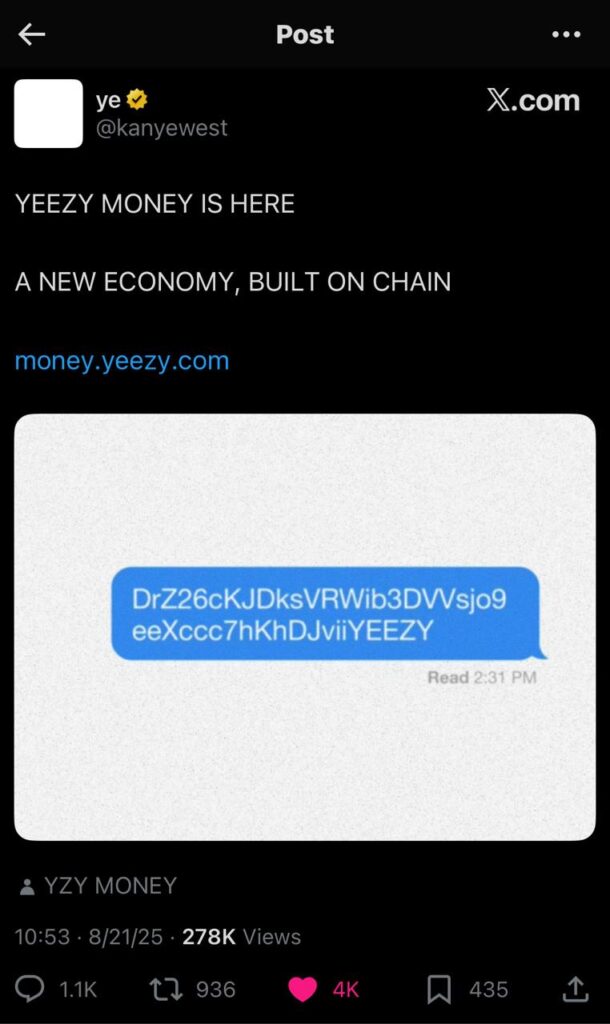

On August 21, 2025, Kanye West (Ye) officially launched the YZY token on the Solana blockchain.

Within just 10 minutes, its market cap skyrocketed to $3.1 billion, only to fall back to the $1.4B–$2B range shortly after.

On the official site money.yeezy.com, YZY is described as “a new financial system free from centralized authority.”

Social channel : https://x.com/yzy_mny

📌 YZY Token Specs

- Blockchain: Solana

- Total Supply: 996.8 million tokens

- Distribution:

- 70%: Yeezy Investments LLC (owned by Kanye)

- Effectively giving Kanye direct control over most of the supply

- Locked with 3/6/12-month cliffs and 24-month vesting

- 20%: Public trading

- 10%: Liquidity pool

- 70%: Yeezy Investments LLC (owned by Kanye)

- Official Contract Address:

DrZ26cKJDksVRWib3DVVsjo9eeXccc7hKhDJviiYEEZY - Security: Vesting enforced via Jupiter Lock to prevent early dumping

👉 In short: Kanye controls over 70% of the supply — a critical risk factor for investors.

💡 YZY Money Ecosystem & Utility

Kanye envisions YZY not just as a meme coin but as the currency powering a Yeezy-branded decentralized financial ecosystem.

- YZY Token

- Planned integration for payments on yeezy.com (sneakers, apparel, accessories)

- Loyalty rewards: holders gain access to limited-edition drops, concert tickets, digital content

- Future governance & staking functions

- Ye Pay

- Payment processor supporting YZY, USDC, and credit cards

- Promises 3.5% lower fees than Shopify

- Designed for small businesses and independent creators

- YZY Card

- A physical debit card to spend YZY or USDC globally

- No fiat conversion required

👉 The broader vision: combining fashion, music, and DeFi into a lifestyle-driven financial system.

📈 Market Performance & Volatility

- Launch frenzy: Market cap surged from $200M → $2B → $3.1B in minutes

- Price action: $0.99–$3.16 range, up 6,800% at peak, now back near $1.47

- 24h Trading Volume: ~$386M

🚨 On-chain data revealed whales and insiders taking massive profits — with one wallet netting $6M+ within hours.

📊 Exchange Listings (As of Aug 21, 2025)

- DEX: Raydium, Jupiter, Meteora (liquidity pools $120M–$170M)

- CEX:

- KuCoin (listed YZY/USDT, Aug 21)

- Poloniex (listed YZY/USDT, Aug 21)

- Bitget (with trading event, Aug 21–24)

- Bybit Futures trading

- Binance Alpha

- CoinMarketCap (tracking liquidity and markets)

⚠️ Key Risks

- Extreme Centralization – Kanye (via Yeezy Investments LLC) controls 70% of supply; top 6 wallets hold 90%+

- Insider Trading Allegations – Some wallets reportedly bought YZY before the official contract was posted, netting millions in quick profit

- Liquidity Pool Concerns – USDC-free pools allow potential price manipulation

- Regulatory Risks – SEC scrutiny over celebrity tokens possible

- Unclear Utility – Ye Pay and YZY Card lack technical details or release dates

- Kanye’s Reputation – Past controversies (antisemitic remarks, Shopify ban in 2025) may hurt trust

- Precedent of Failure – Other celebrity tokens like TRUMP and LIBRA collapsed after hype cycles

✅ Investor Checklist

- Always verify the official contract address (

DrZ26…) - Treat it as a high-risk, speculative asset — only invest what you can afford to lose

- Follow official updates via money.yeezy.com, KuCoin, and CoinMarketCap

- Factor in both celebrity hype and regulatory risk before considering exposure

📝 Conclusion

The YZY token made headlines by rocketing to a $3.1B market cap within minutes — but it has since crashed, exposing the volatility of celebrity-driven meme coins.

- Upside potential: If YZY integrates with Yeezy.com, Ye Pay, and YZY Card, it could evolve into a unique ecosystem merging fashion, music, and DeFi.

- Downside risks: Token centralization, insider trading, regulatory pressure, and Kanye’s personal controversies raise major red flags.

👉 For now, YZY remains a high-risk speculative play, driven more by Kanye’s star power than by proven utility.

📌 Disclaimer

This article is for informational purposes only and does not constitute financial or investment advice.

Cryptocurrency investments carry high risks and volatility, and you may lose your entire investment.

Always do your own research (DYOR) and consult with a licensed financial advisor before making investment decisions.